All Categories

Featured

Table of Contents

Similar to various other life insurance policy plans, if your customers smoke, use various other forms of tobacco or pure nicotine, have pre-existing health and wellness conditions, or are male, they'll likely have to pay a greater price for a last cost plan (life insurance for burial costs). The older your customer is, the greater their rate for a plan will be, because insurance coverage firms think they're taking on more threat when they use to guarantee older clients.

That's due to the fact that final expense plans have degree (or "taken care of") premiums. The policy will likewise continue to be in force as long as the insurance policy holder pays their costs(s). While several other life insurance policy plans may call for medical examinations, parameds, and going to doctor statements (APSs), final expense insurance coverage do not. That's one of the fantastic aspects of last expense plans - life insurance for funeral expenses.

Funeral Policy Cover

In other words, there's little to no underwriting needed! That being said, there are two major kinds of underwriting for final expense plans: streamlined problem and ensured problem. burial expense life insurance. With streamlined concern strategies, customers typically just have to respond to a few medical-related questions and may be rejected protection by the provider based upon those solutions

For one, this can permit representatives to determine what sort of strategy underwriting would certainly function best for a specific client. And 2, it assists agents limit their client's choices. Some carriers might invalidate clients for coverage based upon what medicines they're taking and for how long or why they've been taking them (i.e., maintenance or therapy).

Average Final Expense Cost

The brief solution is no. A last expense life insurance plan is a kind of long-term life insurance policy plan. This means you're covered till you pass away, as long as you have actually paid all your premiums. While this policy is created to assist your beneficiary spend for end-of-life costs, they are complimentary to use the survivor benefit for anything they require.

Just like any kind of other permanent life policy, you'll pay a regular premium for a last cost plan in exchange for an agreed-upon survivor benefit at the end of your life. Each carrier has different policies and choices, but it's relatively very easy to manage as your beneficiaries will certainly have a clear understanding of just how to spend the cash.

You might not need this kind of life insurance policy (the largest final expense for most families would be). If you have permanent life insurance coverage in location your final expenses may currently be covered. And, if you have a term life plan, you may be able to transform it to a long-term plan without several of the extra steps of getting final expenditure coverage

Burial Insurance For Parents Over 60

Designed to cover limited insurance policy needs, this kind of insurance coverage can be a budget-friendly choice for people that simply desire to cover funeral costs. (UL) insurance coverage remains in place for your whole life, so long as you pay your premiums.

This option to last expense coverage offers choices for added family members coverage when you need it and a smaller sized insurance coverage quantity when you're older. burial insurance state farm.

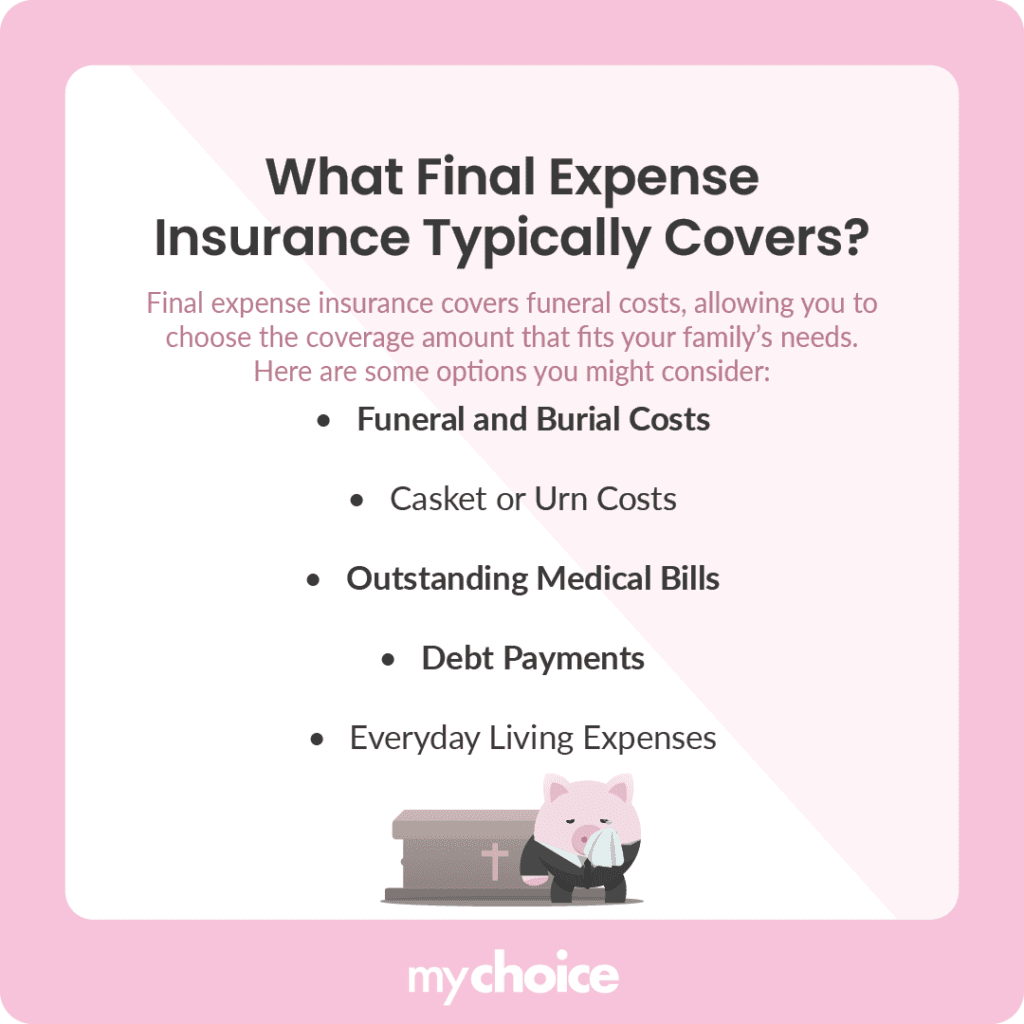

Neither is the thought of leaving loved ones with unforeseen expenses or debts after you're gone. compare funeral covers. Think about these 5 truths about last costs and just how life insurance can assist pay for them.

Table of Contents

Latest Posts

Instant Life Funeral Cover

What Is A Funeral Policy

Funeral Cover Under 50

More

Latest Posts

Instant Life Funeral Cover

What Is A Funeral Policy

Funeral Cover Under 50